Billease loan is a safe and convenient way to get cash advance. It can be used for a variety of purposes, including covering unexpected expenses or large purchases. The money is generally deposited into your bank account within an hour of applying for it, and customers are able to contact customer service via email or phone if they have questions.

Using a Billease Finance Calculator

Using a billease finance calculator can help you decide how much you should borrow and which payment plan is best for your needs. It can also tell you how long it will take to pay off your advance. This is especially useful for people who have bad credit, as it can help them assess different options and choose the best option for them.

Shop Now, Pay Later with BillEase

With BillEase, you can purchase items from selected merchant stores in the Philippines by spreading your payments over simple installment plans. The process is easy and convenient, and it’s even available to non-banking customers, who can use the billease app without having to provide a credit card or bank account.

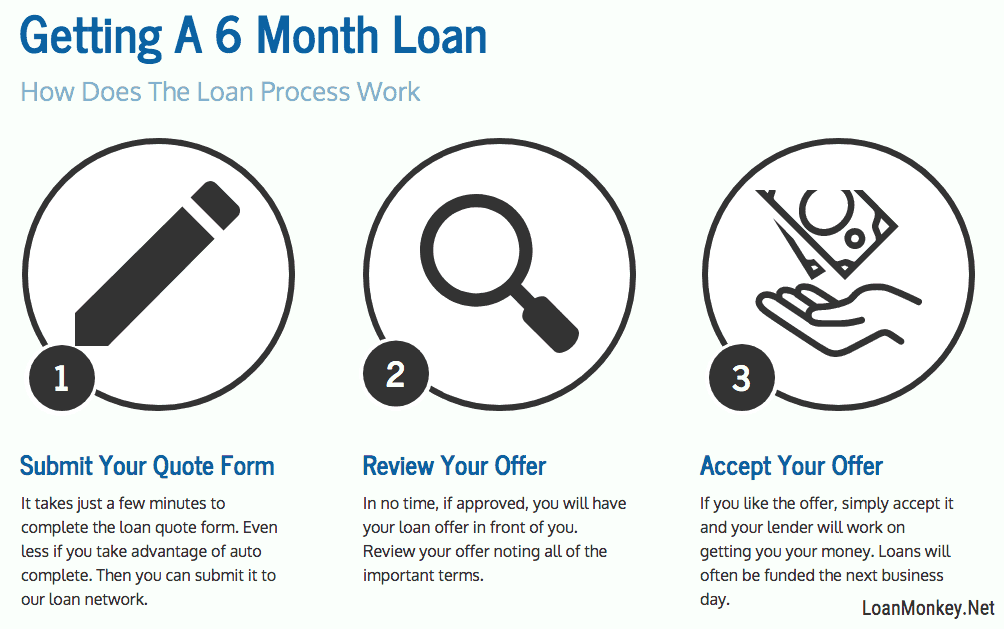

How to Apply for a Billease Loan

To apply for a billease loan, you need to create an account on the BillEase app and verify it. The uploan ph process takes less than five minutes and involves uploading 1 valid ID, proof of income and billing, and 2 character references.

After registering, you can add up to P40,000 in your BillEase Wallet, with a maximum of 24 monthly installments payable. This amount includes your down payment, interest, and service charge.

How to Unlock a Second BillEase Loan

After successfully paying off your first billease loan, you can request to increase your billease loan credit limit. Your initial credit limit is P6,000, and it can be upgraded as you use your BillEase account more frequently for online shopping.

The new BNPL loan application can be done on the mobile app, and it’s easy to apply for a billease loan on the go. To do this, log in to your account and select the Installments tab.

After completing the application, you’ll receive an OTP to your registered mobile number, which you should set up in case you need to access your loan again. After that, you can sign the contract and start receiving your money.